Board of Directors

TCI's Board of Directors

Diversity, Expertise, and Independence of the 2024 Board of Directors

The governance of TCI Co., Ltd. is guided by a commitment to board diversity, professionalism, and independence. The current Board of Directors was elected on June 27, 2023, for its 15th term, with a tenure lasting from June 27, 2023, to June 26, 2026.

To strengthen corporate governance and enhance the structure of the board, TCI follows the principles outlined in its Corporate Governance Best Practices Guidelines, ensuring the implementation of a Board Diversity Policy.

The current Board of Directors consists of six members, including:

- Three Directors

- Three Independent Directors

The board members bring expertise across accounting, finance, biotechnology, business, and management, contributing diverse industry experience and specialized knowledge.

Commitment to Gender Diversity

TCI is committed to gender equality in board representation. The company has set a target of at least 25% female representation. Currently, three out of six board members are women, achieving a 50% female board representation.

Nomination and Selection Process

TCI has established a Nomination Committee and follows a candidate nomination system. All board candidates undergo a nomination and qualification review by the Nomination Committee. Final candidates are approved by the Board of Directors before being presented for election at the Shareholders' Meeting.

Board Competencies

According to Article 20 of the Corporate Governance Best Practices Guidelines, directors should possess the necessary knowledge, skills, and ethical standards to fulfill their responsibilities effectively. To achieve optimal corporate governance, the board as a whole is expected to demonstrate expertise in the following areas:

- Business judgment and decision-making

- Accounting and financial analysis

- Corporate management

- Crisis management

- Industry knowledge

- Global market perspective

- Leadership

- Strategic decision-making

The Board of Directors

| Title | Name | Gender | Education | Experience |

| Chairman | Yung-Chiang Investment Co., Ltd. Representative: Yung-Hsiang Lin |

Male | Bachelor Degree in Botany, National Chung Hsing University |

Chairman, TCI Co., Ltd. |

| Director |

Yang Guang Investment Co., Ltd. |

Female | Master’s Degree in Business Administration, National Taiwan University EMBA School of Professional Education and Continuing Studies, National Taiwan University |

Convener of Audit Committee and member of Remuneration Committee |

| Independent Director |

Maxigen Biotech Inc.

Representative:

Ching-Ting Chen

|

Female |

Master’s Degree in Accounting, National Taiwan University |

Member, Audit Committee Member, Compensation and Remuneration Committee Member, Nomination Committee Member, Risk Management Committee Former: Certified Public Accountant (CPA), PricewaterhouseCoopers Taiwan (PwC Taiwan) Independent Director, TaiGen Biomedical Co., Ltd. |

| Director | Shu-Min He | Female | Master's Degree in Accounting, National Taiwan University | Member of Remuneration Committee Member of Audit Committee and Nomination Committee Independent Director, Cal-Comp Precision Holding Co., Ltd. Former: Certified Public Accountant, PwC |

| Independent Director | Sung-Yuan Liao | Male | Ph.D., National Chung Hsing University | Member of Remuneration Committee Member of Audit Committee and Nomination Committee Former: Associate Professor, Department of Life Sciences, National Chung Hsing University |

| Independent Director | Chen-Yi Kao | Male | Ph.D. in Chemistry, Tufts University | Member of Remuneration Committee Member of Audit Committee and Nomination Committee Professor, Graduate Institute of Biochemistry, National Chung Hsing University |

Functional Committees

Composition, Responsibilities, and Operations

Audit Committee

The Audit Committee is established to assist the Board of Directors in overseeing the company’s accounting, auditing, financial reporting processes, and financial controls to ensure quality and integrity.

The committee is responsible for reviewing and overseeing the following key areas:

- Financial statements and reporting

- Auditing and accounting policies and procedures

- Internal control systems

- Major asset or derivative transactions

- Significant loans, endorsements, or guarantees

- Fundraising or securities issuance

- Regulatory compliance

- Transactions involving managers, directors, or potential conflicts of interest

- Employee grievance reports and fraud investigations

- Corporate risk management

- Appointment, dismissal, or compensation of external auditors

- Hiring, dismissal, or evaluation of financial, accounting, and internal audit executives

In accordance with the laws of the Republic of China (Taiwan), the Audit Committee is composed entirely of independent directors. The committee has the authority to conduct audits and investigations as necessary, as stipulated in its charter. It maintains direct communication channels with internal audit personnel, external auditors, and all employees. Additionally, the Audit Committee has the authority to appoint and supervise legal advisors, accountants, or other consultants to support its functions.

For details on committee meetings and attendance records, please refer to the company’s annual reports.

The members of Audit Committee:

HE, SHU-MIN (female)

LIAO, SONG-YUAN (male)

GAO, ZHEN-YI (male)

Remuneration Committee

The Compensation and Remuneration Committee is established to ensure a fair, transparent, and structured compensation system for the company’s directors, supervisors, and executives. The committee operates in accordance with the Regulations Governing the Establishment and Exercise of Powers of Remuneration Committees of Companies Listed on the Stock Exchange or Traded Over the Counter to uphold compliance and corporate governance principles.

Performance Evaluation & Compensation Policy

The committee is responsible for overseeing the policies, systems, standards, and structures related to the performance evaluation and compensation of directors and executives.

In 2024, the committee’s discussions covered:

- Director and executive compensation allocation

- Executive salaries

- Employee stock option plans

- Annual bonus distribution

All agenda items were presented in detail by the Talent Development Center, ensuring comprehensive explanations and discussions. The committee conducted in-depth deliberations on performance evaluation, compensation policies, systems, and standards before reaching conclusions.

The conflict of interest policy was strictly enforced throughout all 2024 discussions. All resolutions were unanimously approved by the attending committee members and subsequently submitted to the Board of Directors for final approval.

Risk Management Committee

To strengthen the company’s risk management framework and enhance corporate governance, the Risk Management Committee was established by a Board resolution on May 6, 2022.

Key milestones:

- December 29, 2021 – The Board approved the adoption of the Risk Management Policy.

- August 5, 2022 – The Board approved the establishment of the Risk Management Committee Charter.

2024 Risk Management Scope, Structure, and Operations

The Risk Management Committee members are appointed by the Board of Directors and must consist of at least three members, with more than half being independent directors. At least one member must have professional expertise relevant to the committee’s responsibilities and must undergo annual risk management training (3-6 hours).

Committee Responsibilities

- Reviewing the Risk Management Policy.

- Assessing the appropriateness of the risk management framework.

- Reviewing major risk management strategies, including risk appetite and tolerance levels.

- Evaluating risk management reports on significant issues and overseeing improvement mechanisms.

- Reporting risk management implementation progress to the Board of Directors on a regular basis.

2024 Risk Management Training & Key Meetings

- Risk Management Training – December 13, 2024

- Board of Directors Meeting – December 19, 2024

- Risk Management Committee Meeting – December 19, 2024

Risk Management Policy

The objective of risk management is to identify and mitigate internal and external factors that may impact the company’s business strategy and performance. To enhance corporate governance and ensure sustainable operations, TCI has established a Risk Management Policy to prevent potential losses and optimize resource allocation.

Risk Management Process

The Risk Management Policy outlines a structured risk management process, consisting of three levels of oversight:

- Sustainability Steering Committee (Chaired by the Chairman)

- Risk Management Group (Under the Sustainability Steering Committee)

- Operational Departments (First Line of Risk Control)

Key Management Policies

Integrity Policy

Integrity is TCI’s core governance principle, with zero tolerance for bribery or corruption. Employees and directors comply with corporate laws and follow the Code of Integrity, Ethical Conduct for Directors & Executives, Corporate Integrity Guidelines, and Insider Trading Prevention Policy.

- The Integrity Policy is aligned with industry best practices and disclosed on the company website.

- The Board approved the revised Integrity Code on April 30, 2020.

Corporate Integrity Training:

- The Legal Department oversees integrity initiatives and reports to the Board annually (next report: Dec 19, 2024).

- 2024 Training:

- Prohibition of Insider Trading (All employees) – Online from March 12, 2024.

- New Employee Compliance Training – Ongoing throughout 2024.

Board Governance Policies

The Board convenes at least once per quarter, with additional meetings held as needed in urgent situations. Meeting notices must include the agenda and be sent to directors and independent directors at least seven days in advance, along with complete meeting materials. If information is insufficient, directors may request additional documents or propose a postponement for further review. Board procedures adhere to regulations for publicly listed companies, covering key topics, procedures, meeting minutes, and disclosure requirements. Resolutions require the attendance of more than half of the board members, with decisions made by a majority vote of attending directors. Directors are expected to maintain high ethical standards and self-discipline. If a director or their represented entity has a conflict of interest on a proposal, they must disclose it during the meeting. If the matter could potentially harm company interests, the director must abstain from discussion and voting and cannot act as a proxy for another director. Conflict of interest provisions are clearly outlined in the Board Meeting Rules.

Implementation in 2024

Training Sessions on Trading Restrictions for Directors and Insiders

-

Q1 Board Meeting (May 9, 2024)

Topic: Prohibition on Stock Trading During Closed Periods (Part I)

Announcement Date: April 18, 2024

Restricted Trading Period: April 23 – May 9, 2024

Participants: All directors and insiders

Duration: 1 hour -

Q2 Board Meeting (July 30, 2024)

Topic: Prohibition on Stock Trading During Closed Periods (Part II)

Announcement Date: July 12, 2024

Restricted Trading Period: July 14 – July 30, 2024

Participants: All directors and insiders

Duration: 1 hour -

Q3 Board Meeting (November 7, 2024)

Topic: Prohibition on Stock Trading During Closed Periods (Part III)

Announcement Date: October 22, 2024

Restricted Trading Period: October 22 – November 7, 2024

Participants: All directors and insiders

Duration: 1 hour

Information Security Management

Information Security Risk Management Framework

The company has established a dedicated information security unit and appointed an Information Security Officer responsible for overseeing cybersecurity policies. In compliance with regulatory requirements (Financial Supervisory Commission Order No. 11003656544), the company was required to appoint a Chief Information Security Officer (CISO) and at least one cybersecurity personnel by 2023 to ensure proper cybersecurity planning, monitoring, and execution.

Information Security Unit: Strategic Data Center

Chief Information Security Officer (CISO): Mr. Chen Xin-Liang (Appointed on December 19, 2023, by Board resolution)

Regular Review of Cybersecurity Policies

-

December 19, 2023: Strengthened cybersecurity protection and management mechanisms to safeguard confidential information and enhance security preparedness in times of crisis.

-

December 19, 2024: Optimization and enhancement of the company’s information security management framework to further solidify cybersecurity defenses.

Cybersecurity Policy

The company has implemented a comprehensive Information Security Management System (ISMS), fostering cross-departmental collaboration to ensure business continuity and risk assessment effectiveness. The company adheres to a structured Plan-Do-Check-Act (PDCA) approach to maintain an efficient cybersecurity framework. All incidents and anomalies are assessed following standard procedures, with the goal of achieving ISO 27001 certification in January 2025.

Key Cybersecurity Initiatives

-

Proactive Defense Mechanisms: Integration of cybersecurity controls into daily IT operations, hardware/software maintenance, and risk management.

-

Layered Protection Strategies:

-

Network Security: Upgraded firewall systems and enhanced network controls to prevent external threats.

-

System & Equipment Security: Regular system scans and software updates to prevent malware intrusions.

-

Employee Awareness Training: Conducting cybersecurity education and social engineering exercises to enhance awareness.

-

Resource Allocation for Cybersecurity Management

Personnel:

-

1 Dedicated Chief Information Security Officer

-

1 Dedicated Cybersecurity Specialist

Meeting and Compliance Schedule:

-

Annual cybersecurity management review meetings, with procedural updates as needed

-

Annual internal and external audits

-

Weekly security incident tracking based on SOC & TWCERT alerts

-

Quarterly antivirus and SOC review meetings

-

24/7 MDR monitoring with real-time incident alerts and SOC reporting

Compliance with International Standards:

The company has adopted ISO 27001, CNS 27001, or equivalent information security management standards, with third-party certifications ensuring compliance. The validity period of certifications extends through 2024.

Internal Audit Management

The purpose of internal audit the Company is to assist the Board of Directors and management in reviewing and assessing deficiencies in the internal control system, evaluating operational effectiveness and efficiency, and providing timely improvement recommendations to ensure the continuous and effective implementation of internal controls and as a basis for reviewing and revising the internal control system.

Appointment, Evaluation, and Compensation of Internal Audit Personnel

The appointment, evaluation, and compensation of internal audit personnel are handled in accordance with Article 14-5 of the Securities and Exchange Act, first approved by the Audit Committee and then resolved by the Board of Directors. In addition to complying with relevant legal regulations, the process also follows the organizational rules of the Audit Committee and the Compensation Committee.

Independent Directors and Auditor Communication Report 2024

In 2024, independent directors held four communication sessions with auditors, facilitated by Independent Director Liao Song-Yuan, representing the Audit Committee. These discussions were documented and filed with PricewaterhouseCoopers (PwC) for reference.

Key meeting dates and topics:

-

March 15, 2024: Approval of the 2023 annual business report and financial statements

-

May 9, 2024: Review of the Q1 2024 consolidated financial statements

-

July 30, 2024: Review of the Q2 2024 consolidated financial statements

-

November 7, 2024: Review of the Q3 2024 consolidated financial statements

All agenda items were acknowledged and approved unanimously by all independent directors.

Independent Directors and Internal Audit Supervisor Communication Report

A dedicated meeting was held to discuss internal audit matters:

-

Date: July 30, 2024 (Tuesday, 2:30 PM)

-

Location: 8th-floor conference room, Taipei Headquarters

-

Attendees: Independent Directors Liao Song-Yuan, Gao Zhen-Yi, Li Shi-Ming, and He Shu-Min

-

Purpose: Guidance and recommendations for internal audit operations

Audit Supervisor Report:

-

Execution status and key focus areas of the 2024 audit plan

-

Key audit objectives for 2024

Independent directors acknowledged and provided guidance for internal audit processes.

Board Assessment of Auditor Independence and Competency Using Audit Quality Indicators (AQIs)

During the sixth Board Meeting on December 19, 2024, the Board evaluated the independence and competency of the appointed auditors.

Discussion:

-

The company's 2024 financial audit was conducted by PwC accountants Zhi Bing-Jun and Lai Zong-Xi.

-

In accordance with Article 29 of the Corporate Governance Best Practice Principles, publicly listed companies must evaluate their appointed auditors’ independence and competency at least once annually using AQIs. The evaluation considered PwC’s audit quality report and aligned with the Code of Professional Ethics for Certified Public Accountants in Taiwan (No. 10) on integrity, impartiality, and independence. The assessment was reviewed by the accounting department, with auditors submitting an independence declaration for reference (Appendix 8).

-

The Audit Committee reviewed and approved the assessment before submitting it to the Board for resolution.

-

Resolution: The proposal was unanimously approved by all attending directors.

Independence Assessment Report on Engaged Auditors for 2024

Auditing Firm: PricewaterhouseCoopers (PwC) Auditors: Zhi Bing-Jun and Lai Zong-Xi

Key considerations for auditor independence:

-

No direct or significant indirect financial interests between the appointed auditors and the company.

-

No inappropriate financial or business relationships exist between the appointed auditors and the company.

-

Auditors and their staff must uphold integrity, impartiality, and independence.

-

Auditors have not served as the company’s directors, supervisors, or senior executives in the past two years and will not do so during the audit period.

-

Auditors and their immediate family members do not hold any positions that may directly or significantly influence audit work within the company.

-

Auditors must not accept substantial gifts or hospitality from the company’s directors, supervisors, or executives beyond standard social courtesies.

-

Auditors' names must not be used for unauthorized third-party activities.

-

Auditors must not have any loan arrangements with the company, except under normal banking relationships.

-

Auditors must not operate businesses that may compromise their independence.

-

Auditors must not receive any commissions related to their work.

-

Auditors must not hold shares in the company.

-

Auditors must not have contingent fees related to the audit work.

-

Auditors must not have any potential employment relationships with the company.

-

Auditors must not take on regular salaried roles within the company.

-

Auditors must not engage in shared investments or financial interests with the company.

-

Auditors must not participate in the company's management decisions.

Evaluation Unit: Accounting Department

TCI Co., Ltd. 2023 Annual Assessment Report on the Independence of CPAs

The CPA Firm in 2023: PricewaterhouseCoopers Taiwan

The CPAs in 2023: Ming-Chuan Hsu and Ping-Chun Chi

1. The appointed accountants have no significant financial interest in the Company.

2. The appointed accountants shall avoid any inappropriate relationship with the Company.

3. The appointed accountants should ensure that their assistants are honest, impartial and independent.

4. The appointed accountant has not held the position of director, supervisor or manager of the company or any position that has a significant influence on the audit case within the past two years; it is also determined that he will not hold the aforementioned relevant positions during the future audit period.

5. During the audit period, the appointed accountants and their spouses or dependent relatives have not served as directors and supervisors of the Company or have direct and significant influence on the audit work. During the audit period, the close relatives within the fourth degree of kinship of the appointed accountants who are the directors or managers of the Company or who have direct and significant influence on the audit work shall reduce their noncompliance with the independence procedures to an acceptable extent.

6. The appointed accountants have not given or accepted any benefits or gifts with a great value (the value that exceeds the standard of general social etiquette).

7. The name of an appointed accountant shall not be used by others.

8. Loans between the appointed accountants and the Company are not allowed, excluding normal transactions with the financial industry.

9. The appointed accountants shall not concurrently engage in other businesses that may lead to the loss of their independence.

10. The appointed accountants shall not receive any commission related to the business.

11. The appointed accountants shall not hold shares of the Company.

12. The appointed accountant and the Company shall not have any contingent official expenses related to the examination of the case.

13. The certified public accountant shall not have any potential employment

relationship with the Company.

14. The appointed accountants shall not concurrently serve as regular employees of the Company and shall be entitled to a fixed salary.

15. The appointed accountants shall not have a joint investment or share of interest with the Company.

16. The appointed accountants shall not be involved in the management functions of the Company in making decisions.

Evaluation unit: Accounting department

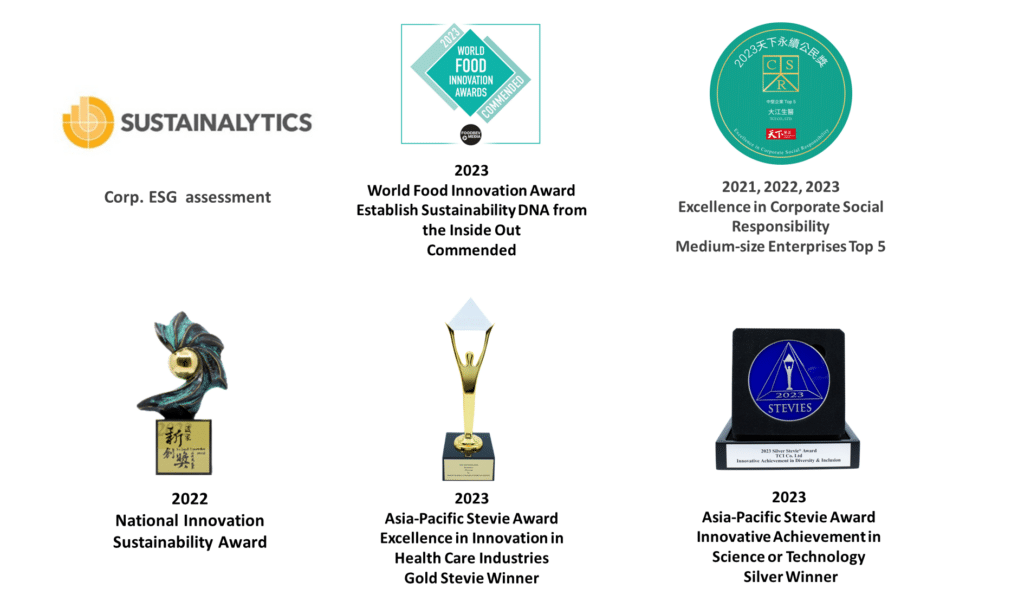

Awards

The Board of Directors, at least annually, makes reference to Audit Quality Indicators (AQIs) to evaluate the independence and competence of the signing auditor